How can i buy stock for facebook

How To Buy Facebook Stock (META) – Forbes Advisor

Updated: Jul 26, 2022, 7:59am

Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors' opinions or evaluations.

Getty

With nearly two billion daily active users on its platform and nearly $120 billion in annual sales, Facebook is a global phenomenon and a revenue-generating juggernaut. The company has recently rebranded as Meta Platforms, Inc. If you’re interested in adding some Meta stock to your portfolio, here’s how to get started.

How to Buy Facebook Stock (META)

1. Open a Brokerage Account

If you’re looking to buy Facebook or any other stock, you need a brokerage account to handle the transactions. Available services, fees and investment options differ from one broker to the next, so it’s smart to shop around to find one that fits your preferences. Check out our listing of the best online brokers to get started.

Featured Partner Offers

1

SoFi Automated Investing

1

SoFi Automated Investing

Learn MoreOn Sofi's Website

2

Betterment

2

Betterment

Learn MoreOn Betterment's Secure Website

Paid non-client of Betterment. Views may not be representative, see more reviews at the App Store and Google Play Store. Learn more about this relationship.

3

Wealthfront

3

Wealthfront

Learn MoreOn WealthFront's Website

2. Choose an Account to Match Your Goals

After you settle on the right brokerage platform, decide what kind of account you need. Your choice of account should match your investing goals.

- Retirement accounts. Individual retirement accounts (IRAs) give you tax advantages when you save for retirement. IRAs come with one big limitation: If you withdraw money before you are at least 59 ½, you’ll owe a 10% penalty, plus any applicable taxes.

- Taxable accounts.

While taxable brokerage accounts don’t offer any special tax benefits, you can withdraw funds at any time, for any reason. This gives you flexibility when it comes to building general purpose wealth.

While taxable brokerage accounts don’t offer any special tax benefits, you can withdraw funds at any time, for any reason. This gives you flexibility when it comes to building general purpose wealth.

3. Decide How Much to Invest in Facebook

When buying individual stocks, there are a few factors you should take into consideration. To determine how much money to invest in Facebook, make sure you ask yourself the following questions:

- What’s your budget? Before buying a stake in Facebook, consider your other budget items. After you’ve paid the bills, make sure you’re saving enough for retirement and that you have a solid emergency fund.

- What’s FB’s current price? Like all stocks, shares of Facebook fluctuate in price constantly. You can certainly buy a single share of FB, but consider that you could also purchase a part of a share, known as a fractional share. Brokerages like Charles Schwab, Fidelity, Stash and Robinhood allow investors to purchase fractional shares.

- What’s your investing strategy? You may choose to make a single purchase of Facebook all at once or you can use dollar cost averaging by purchasing the same dollar amount of the stock at regular intervals, no matter what the stock costs at the time. Dollar-cost-averaging can help reduce your risk of volatility and save you money on the cost-per-share over time.

- What about your other investments? How does FB fit into your overall investment strategy? Do you own a lot of other large-cap technology stocks, or will Facebook be your first investment in this sector? Making sure you have a diversified portfolio that represents several different industries and company sizes can help ensure a healthy portfolio.

4. Determine Your Order Type and Place Your Order

You can request that your brokerage purchase shares of Facebook stock at the current price or use a more advanced order type, like limit orders or stop orders. These types of orders only purchase shares once the stock price falls below a certain threshold.

Facebook is traded on the Nasdaq stock exchange, and its shares can be bought or sold between 9:30 a.m. and 4:00 p.m. ET, Monday through Friday. If your brokerage platform offers the option, the Nasdaq allows pre-market and after-market trading.

Nasdaq’s pre-market trading hours are 4:00 a.m. until 9:30 a.m., and its after-hours trading runs from 4:00 p.m. until 8:00 p.m. ET. If you place an order outside of the hours your brokerage allows you to trade during, it will be processed once trading resumes.

5. Evaluate Meta’s Performance

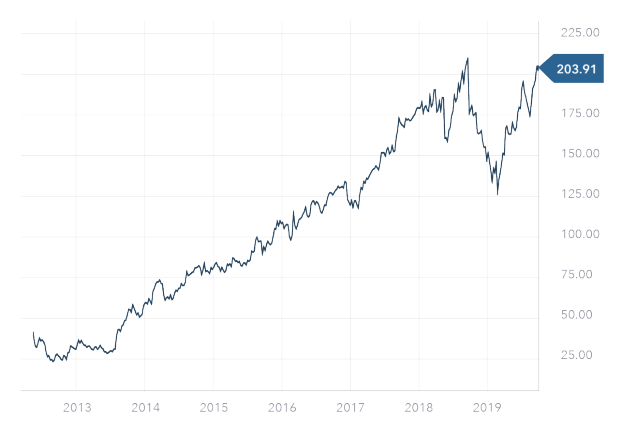

Once you own Meta stock, you should periodically review your investment and its performance.

To evaluate the performance of any stock, start by reviewing the annualized percent return. This will give you a number you can compare to other assets as you gauge how well your investment in META has performed.

Compare Facebook’s performance to benchmark indexes such as the Nasdaq 100 or the S&P 500. This shows you how Facebook has been doing in comparison to the stock market in aggregate.

Since Facebook is publicly traded, it is required to file both Form 10-K annual reports and Form 10-Q quarterly reports to disclose its performance and finances.

Facebook provides this information on its investor relations site, and it can also be found on the SEC database. If looking through these reports feels like you’re trying to read a foreign language, try reading expert analysis of these reports from sites like Morningstar. The information disclosed by Facebook plus the expert analyses you read can help you determine if this is the right stock for your investing needs.

How to Sell Meta Shares

“Buy-and-hold” could be your best investing strategy, but eventually you may want to sell your shares of Facebook. Selling stock works much the same way as buying shares.

Open your online brokerage platform, then enter the Facebook ticker symbol, the number of shares or dollar value of what you want to sell and choose a sell order type. They work more or less the same way as the purchase order types we covered above.

If you’ve made a profit on your investment in Facebook, you may owe capital gains taxes. The amount you owe depends on your annual income and how long you’ve held your Facebook stock. Partnering with a tax professional or certified public accountant (CPA) can help you determine how capital gains taxes may affect the sale of your META stock or other investments.

Invest in Facebook with an ETF or an Index Fund

Buying shares of Meta Platforms is just one way of adding the company to your portfolio. You can also invest in Facebook by purchasing shares of index funds or exchange-traded funds (ETFs). Both are available through your online brokerage.

These kinds of funds pool large numbers of stocks together in a single fund, making them less risky than individual stocks. Rather than counting on Facebook alone, with funds you can diversify your holdings across hundreds (or even thousands) of different companies, increasing the chances of overall growth without betting on a single company.

It’s also important to note that Facebook is a major component of many index funds. For instance, it’s on the top 10 list of companies by index weight in the S&P 500, which means that buying an S&P 500 index fund will give you a good amount of exposure to META while still diversifying and protecting your investments.

Was this article helpful?

Rate this Article

★ ★ ★ ★ ★

Please rate the article

Please enter valid email address

CommentsWe'd love to hear from you, please enter your comments.

Invalid email address

Thank You for your feedback!

Something went wrong. Please try again later.

More from

Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. Past performance is not indicative of future results.

Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. Past performance is not indicative of future results.

Forbes Advisor adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners.

John Schmidt is the Assistant Assigning Editor for investing and retirement. Before joining Forbes Advisor, John was a senior writer at Acorns and editor at market research group Corporate Insight. His work has appeared in CNBC + Acorns’s Grow, MarketWatch and The Financial Diet.

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. This compensation comes from two main sources. First, we provide paid placements to advertisers to present their offers. The compensation we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market. Second, we also include links to advertisers’ offers in some of our articles; these “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Here is a list of our partners who offer products that we have affiliate links for.

Here is a list of our partners who offer products that we have affiliate links for.

Are you sure you want to rest your choices?

Overview, How to Buy Shares of Stock + More

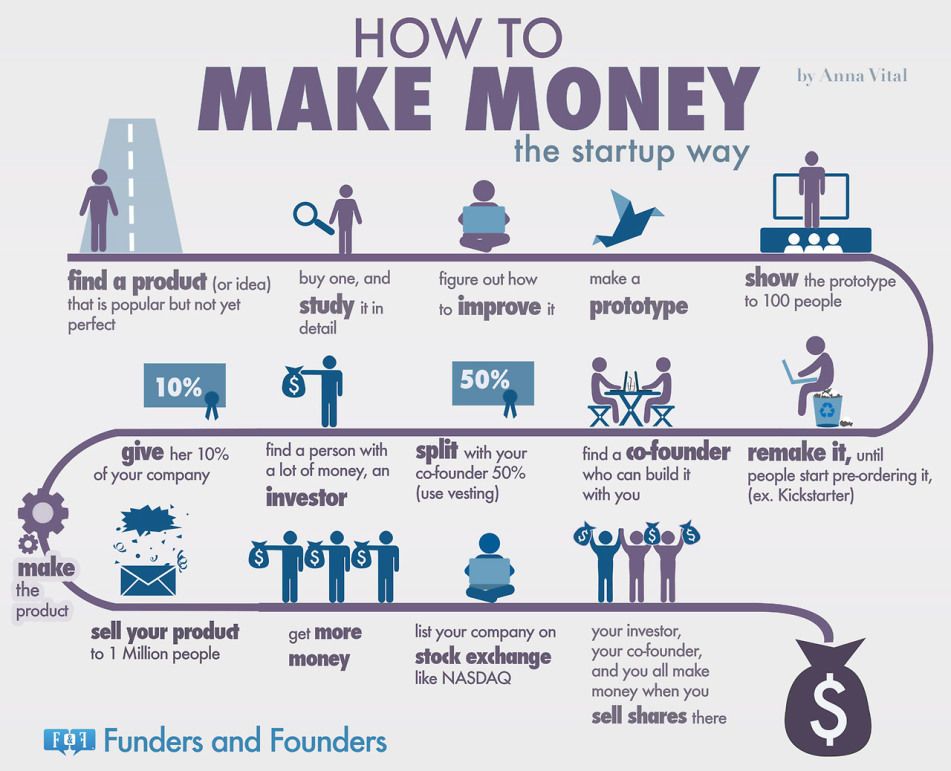

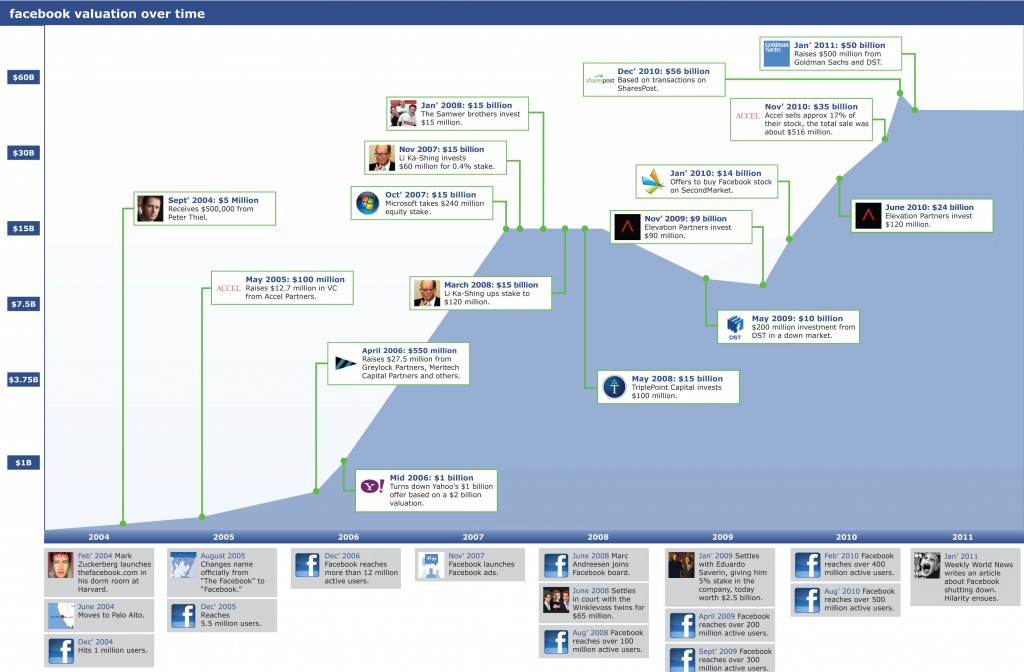

Like most people, you’ve probably imagined buying shares of a company that grows in value and makes you enough money to retire early and live a financially secure life. Facebook stock might have been one of your top choices when it comes to buying shares in a growth company.

Investing can be seen as a complex subject, but there are ways to make your investments more accessible. Many free stock trading platforms simplify the investing process and have democratized access through the elimination of stock commissions.

That means you can buy one share at a time without having to fork over a per-trade commission. Some apps will allow you to set aside money regularly to buy fractional shares, lowering your barrier to investing in these growth stocks even more.

Today, you can buy shares in companies like Facebook fully online through low-cost (or free) brokers.

While I do not specifically advise you to buy Facebook shares of stock, this article explains how to buy stocks, using the company as an example.

If you want other stock recommendations, I suggest subscribing to some:

- investment newsletters

- stock picking services

- stock advisor services

I would also consider conducting your own stock research and using stock analysis websites to vet any investments recommended by these services. Likewise for Facebook stock to see if its risk profile and investment objectives meet your broader investment portfolio goals.

This article does not constitute individualized investment advice under any circumstance.

Table of Contents

Overview of Facebook

Facebook is a social media site that was originally created by Mark Zuckerberg and co-founded a college, Harvard University. The website has grown to be one of the most popular websites in the world with almost three billion monthly active users as of May 2021.

Facebook is free for individuals and allows people to create their own profiles, post images and video. It also offers a platform for users to interact with others through comments on the profile posts or by sending direct messages.

The website has grown in popularity because it allows people to connect with family members they have lost touch over time as well as reconnecting with old high school friends. Facebook is a place where people interact with each other.

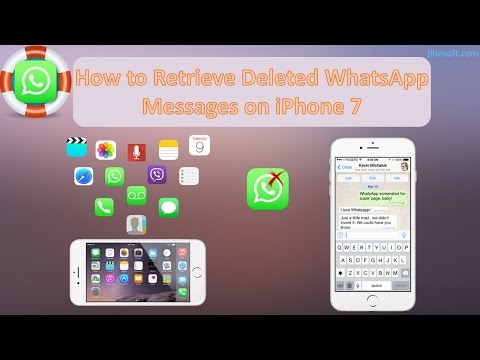

Over the years, Facebook has acquired several related tech companies like WhatsApp, Instagram and Oculus VR.

The company continues to maintain a strong position in the social media market while looking to expand into ecommerce through its rich platform offerings.

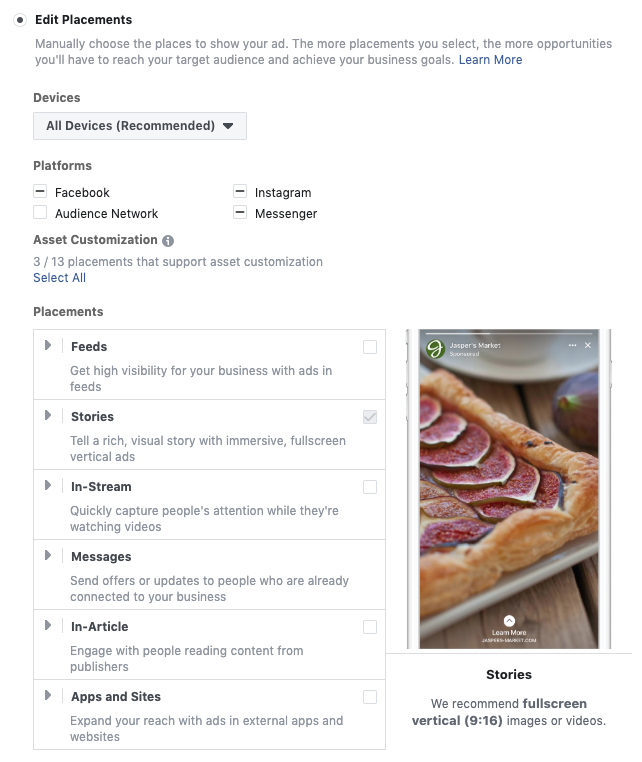

Facebook monetizes its online properties by displaying ads on its website.

The company offers a variety of ad sizes and placements to help businesses promote themselves through Facebook properties.

Facebook has also begun investing in live video with the launch of Facebook Live which allows users to broadcast events as they happen while simultaneously interacting with viewers who can ask questions or comment along the way.

Live videos will be another outlet for users to engage with others and advertisers to find potential customers. The company competes with Google in the display advertising market.

If you’d like to buy Facebook stock, you’ll need to find an online broker that gives you the ability to purchase the stock through the NASDAQ stock market exchange.

However, this does not mean Facebook is a stock worth buying. You will need to decide for yourself if Facebook is a good stock choice for your individual investing situation.

Let’s have a look at the steps needed to buy Facebook stock now!

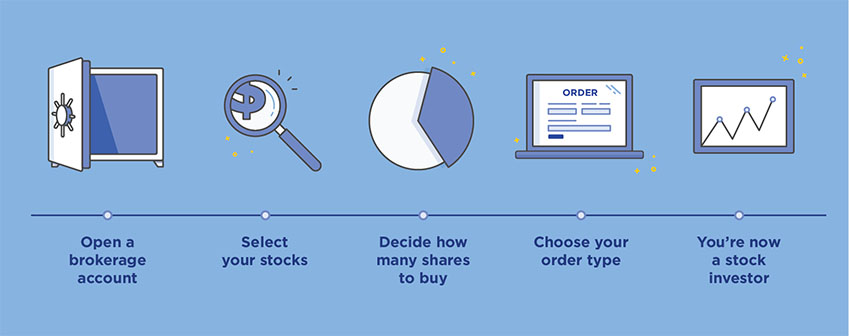

How to Buy Facebook Shares of Stock – Steps to Follow

After you’ve decided buying Facebook is right for you, you’ll need to know where to start looking to invest in the company. If you’re considering buying shares in Facebook, it’s important to consider what lies ahead.

Buying Facebook stock and other companies, index funds or investments is a straight forward process.

→ Step 1: Find a Good Online Broker

When looking for a good online broker, you’ll first want to consider:

- Which markets the broker can access for trading (not all brokers can buy and sell stocks on the NASDAQ)

- Commissions and fees charged by the company for trading

- What types of stocks, funds or investments are available to trade online

- Whether you can open a brokerage account with this company because of your citizenship status

- You’ll also want to consider how much time you’re willing to spend learning a new platform (typically less than an hour)

- Which margin rates the broker offers

The best investing apps for beginners focus on simplicity, functionality, educational and customer support and cost. I can help you find one at the bottom of this section which makes the best fit for your investing needs.

Some even offer sign up bonuses to give your investing journey a boost. Learn how to get free stocks from online brokers for signing up and funding your account.

Consider the following brokerage choices for starting to invest money:

→ Step 2: Open Your Brokerage Account

After finding your online broker, you must open an account to begin trading. Opening an account with an online broker is much like opening a regular bank account, and it typically requires that you go through your computer or the company’s website.

Depending on the broker, your location and the rules required for opening a new investment account, it can vary in time required to open your brokerage account.

Some apps like Robinhood take only a short time to input your information, have the company verify it and then clear you for trading.

Some brokers also have extensive processes or procedures they must follow for risk compliance, regulations or other reasons.

You’ll want to make sure your money is safe on Webull, M1 Finance or any of the other investing apps listed above.

→ Step 3: Deposit Money In Your Account

When you buy shares of Facebook, you’ll need to pay cash for them. This means you will need to deposit money into your account (at least above the minimum opening account balance).

Most brokers enable this instantly through verified services like Plaid. While your transfer clears, some allow you the ability to trade on credit until the funds officially settle in your account.

Thankfully, services like Plaid make this money transfer process quick and easy, not to mention highly secure when funding your brokerage account.

Most brokers rely on direct money transfers from your checking account but others will allow you to deposit money from electronic wallets like PayPal.

→ Step 4: Buy Your Shares of Facebook

Now that you’ve found your broker, opened an account and deposited money, you’re ready to begin investing in stocks like Facebook.

From this point, you’ll need to navigate to the stock within your app, enter the amount of shares (or dollars you’d like to invest with fractional shares) you want to buy, select your preferred order type (e. g., market, limit, etc.) and execute the trade.

g., market, limit, etc.) and execute the trade.

For greater control, you may want to use a limit order as opposed to a simple market order. Limit orders allow you to specify a price you’d like to buy the stock or better while market orders automatically execute at the price available from sellers.

In thinly traded securities with large bid-ask spreads, this can result in a fairly sizable difference between what you see the stock trading for and what you actually pay.

→ Step 5: Track Your Facebook Position Over Time

Once you’ve bought your Facebook stock alongside other suitable investments, you should use the best portfolio management apps to follow it over time.

By monitoring the stock after your initial purchase, you can see how its performance aligns with your overall investment strategy.

Consider reviewing the top brokers below to see which makes the most sense for your needs.

Fees For Investing in Facebook Stock

Despite many of the above brokerages advertising $0 trading commissions, the regulatory authorities in your country may still assess fees to fund their operations. That means you might pay unavoidable fees when you trade Facebook shares and other investments.

That means you might pay unavoidable fees when you trade Facebook shares and other investments.

Commissions, for reference, are fees based on trades you make. They can amount to a flat per trade fee like a fixed dollar amount, or even a percentage of the trade value.

Whether you trade penny stocks on Robinhood or Webull for minimal money or trade whole shares of Berkshire Hathaway, you will need to understand the unavoidable fees charged in some instances.

These fees may vary by brokers. Be sure to check the fine print if these costs to invest appear too great or affect your overall investment decision. They should be very minor and not dramatically impact your inclination to invest in a stock or not.

How to Buy Facebook Shares in South Africa, India and UK

If you live in South Africa, India or the UK and think Facebook is a great company, you might find it difficult to buy stock in the company without using Contract For Differences (CFDs), or a financial arrangement made using financial derivatives that settle differences between open and closing trading prices with cash.-Step-5.jpg/aid890675-v4-728px-Buy-Stocks-(for-Beginners)-Step-5.jpg)

If you want to buy shares of Facebook in South Africa, India or the UK without using CFDs, you can use a Firstrade account.

You simply need to setup your account, get it approved, fund it and find the stock within the app to buy.

Full list of available countries for Firstrade:

How to Invest $50 in Facebook

If you’d like to invest $50 in Facebook, you’ll need to use a fractional shares trading app to make your purchase. Some of the best fractional shares apps to buy the stock include:

- M1 Finance

- Robinhood

- Public

- Stash

How to Reduce Risk in Stock Trading

Investing in stocks comes with inherent risks. This holds true for Facebook stock as well as any other investment traded on stock exchanges.

Consider reviewing the following tips to reduce the risk in stock trading for your portfolio.

→ Avoid the Investing Scams

The risk involved with investing in stocks is not just related to the price of shares. Investors also need to be on guard against scams that may come their way during this time.

Investors also need to be on guard against scams that may come their way during this time.

Many people look to take advantage of the current investment climate by promising returns that they cannot deliver.

Investors should never buy into any offer that seems too good to be true or seeks upfront fees without explaining how those funds will be used.

To avoid scams, investors need to know what their risk tolerance is and invest no more than the amount of money they are willing to lose.

When considering which broker to use, consider the following brokers above. All of these have millions of active users and have stringent cybersecurity protections. Further, they offer secure investments that trade openly on exchanges, allowing further protections of your money from theft or fraud.

→ Diversify Your Portfolio

Investing in a single stock carries significant risk. When purchasing shares of stock, consider diversifying into multiple investments simultaneously.

If you choose to buy Facebook stock, make sure you also purchase other suitable investments to balance out your portfolio.

If you have a diversified portfolio, your risk will be spread out amongst the various investments which can help minimize losses.

As an example, if one of the stocks in your portfolio suffers from a downturn, then it may not affect all other holdings as much because they are less concentrated. This is known as “concentration risk” and can dramatically impact your portfolio without proper investing strategies and risk mitigation precautions in place.

Bottom Line on How to Buy Facebook Shares

After this summary of how to buy Facebook stock online, you should have a clear sense of how to proceed.

Buying Facebook stock is as simple as following these five steps:

- Finding a good broker

- Opening your account

- Funding the account

- Buying the shares

- Reviewing your position regularly

The basics of online stock trading is not difficult to understand. Use this guide as a step-by-step process for buying stocks with trusted brokers from the convenience of your computer or smartphone.

Use this guide as a step-by-step process for buying stocks with trusted brokers from the convenience of your computer or smartphone.

Related:

- How to Buy Apple Shares

- How to Buy Twitter Shares

- How to Buy AMD Shares

- How to Buy Netflix Shares

- How to Buy Tesla Shares

App Store: Facebook

Description

Communicate with friends, relatives and like-minded people. Chat face-to-face, watch interesting content, buy and sell products, or just connect with the community. Facebook helps you stay connected with others. Discover the world or just spend time in good company.

Follow the lives of loved ones:

• Share the news with regular posts and stories.

• Tell about yourself in your profile and publications, watch and comment on content and communicate with friends, how and when you want.

Chat in groups:

• Tens of millions of groups to suit all tastes.

• The content of all the groups you have joined is available in the "Groups" tab. A new search tool and recommendations will help you find groups that match your interests.

Get involved in the community:

• Find out about events, companies and groups in your area.

• See recommendations for planning local trips with friends.

• Do charity work, look for like-minded people and help those who find themselves in a difficult situation.

Watch videos with friends on Watch:

• Enjoy a wide variety of content: shows, vlogs and various popular videos about beauty, sports, entertainment, etc.

• Discuss videos, share content, communicate with creators, viewers and organize joint viewings.

Sell and buy items in the Marketplace:

• In the Marketplace, you can buy anything from consumer goods to cars and real estate.

• List items for sale and interact with buyers and sellers in Messenger.

See our App Store description for our Data Policy, Terms and other important information.

Continuous use of GPS running in the background can significantly affect battery life. Facebook doesn't turn on GPS in the background without your permission when using certain features that require it.

Version 388.0

The app now supports iOS 16 and lock screen widgets.

Ratings and reviews

Ratings: 40.4k

Very bad

To be honest, I don't know how a company that pretends to be high tech and sells its shares for $170 a unit is releasing such blatantly hacky applications.

This is not to mention the fact that the architecture and interface of this social network itself, even in working condition, leaves much to be desired. In a non-working state, it's just hell. More specifically, it's been 2 or 3 weeks already, I just can't log into my account through this, so to speak, application. Deleted, updated 100,000 times. Every time the same story. A window with a security check, "enter the code" (sent to the phone), and so on. I enter the code - the page is stupidly updated with the same proposal to enter the code. As for the code itself, Facebook sends it out several times a day. And even if I introduce freshly received, everything repeats again. This is the worst app I have ever seen. And it continues to be updated, yes.

Stop making huge updates!

Not only do updates appear almost once a week, but they also weigh a ton! Separate messenger nonsense: run back and forth! What are you doing? The application just wants to be deleted in FIG!

Worst app ever.

It is unbearable to use the face because of such a GIANT weight-295 mb!!!!!! Are you seriously ???? I only keep it because I need a fucking ad for instagram!!!!!! I hate you! The slowest app and the busiest! Uninteresting application and heavy. Get better! Develop already! Stop X...she suffer!

Developer Meta Platforms, Inc. indicated that, in accordance with the application's privacy policy, data may be processed as described below. Detailed information is available in the developer's privacy policy.

Data used to track information

The following data may be used to track user information on apps and websites owned by other companies:

- Contact details

- Identifiers

- Other data

Related with user data

The following data may be collected, which is related to the user's identity:

- Health & Fitness

- Purchases

- financial information

- Geoposition

- Contact details

- Contacts

- User Content

- Search history

- Browsing history

- Identifiers

- Usage Data

- Confidential Data

- Diagnostics

- Other data

Sensitive data may be used differently depending on your age, features involved, or other factors. Read more

Read more

Information

- Provider

- Meta Platforms Inc.

- Size

- 308 MB

- Category

- Social networks

- Age

- 12+ Small/moderate amount of foul language or crude humor Small/moderate use or reference to alcohol, tobacco or drugs Small/moderate content of a sexual or erotic nature Few/moderate adult-only topics

- Copyright

- © 2022 Meta

- Price

- Free

- Developer site

- Application support

- Privacy Policy

Supported

Other apps from this developer

You may like

all about buying company shares in 2022

A Ukrainian private investor is significantly limited in his ability to buy shares of foreign corporations. Inside Ukraine, he has almost no such opportunities, and the ability to withdraw funds abroad is limited by Ukrainian law. However, if you really want to buy foreign shares, you can find several ways.

Inside Ukraine, he has almost no such opportunities, and the ability to withdraw funds abroad is limited by Ukrainian law. However, if you really want to buy foreign shares, you can find several ways.

The first method is the most legal

Following the letter of the law, in order to acquire shares of a foreign issuer, by February 2019, a Ukrainian investor had to obtain a license from the National Bank to invest abroad. In order to obtain such permission, it was necessary to decide in advance which shares you want to buy, in what quantity and for what amount. After that, the investor had to collect the necessary package of documents, submit it to the main office of the NBU and wait for a decision.

With the entry into force on February 7, 2019 of the new Law of Ukraine "On Currency and Currency Operations", the need for individuals to obtain an individual currency license for investing abroad has been canceled. However, not all investors can rejoice. There are no licenses now, but there are "e-limits" - limits on the amount of funds that can be transferred for certain purposes abroad. Individuals can invest abroad or deposit up to 200,000 euros per year in a foreign account. (according to the Resolution of the NBU Board No. 5 dated January 2, 2021)

There are no licenses now, but there are "e-limits" - limits on the amount of funds that can be transferred for certain purposes abroad. Individuals can invest abroad or deposit up to 200,000 euros per year in a foreign account. (according to the Resolution of the NBU Board No. 5 dated January 2, 2021)

Advantages of the method:

- absolute legitimacy,

- legal protection and guarantees of investor's property rights.

Drawbacks:

- the presence of restrictions on the amount of investment.

Method two - the most "direct"

If you would like to trade on a foreign exchange through Internet trading, you can try to follow the path of least resistance. Namely: go abroad and just open an account with a local broker.

Advantages of the method:

- the ability to buy shares at any time and in any quantity and control the placement of their funds, trade through Internet trading or give instructions to a broker;

- your property rights are protected by the laws of the country where the account is opened.

Drawbacks:

- the investor must personally travel abroad to open an account and invest

- in case of exceeding the online limit of 50 thousand euros, the investor violates Ukrainian legislation and risks being liable for this before the law.

The third method is the most risky

If it is not possible to travel abroad to open an account, you can try to buy foreign shares "sitting on the couch". A simple search on the Internet gives a fairly large list of companies offering everyone to connect to trading on foreign exchanges: mostly American (NYSE, NASDAQ), but options are possible here.

To connect to the service, you do not even have to leave your home: a sample contract will be sent to you by e-mail, after which you will have to fill it out and send it back along with a scanned copy of your passport. After that, you will need to download a program for installing a trading terminal from the company's website and transfer money using the details sent to you. Within a few days, an account will be opened for you, and you will be able to start trading.

Within a few days, an account will be opened for you, and you will be able to start trading.

Another advantage of such a service is that you do not actually violate the law: the organization with which you conclude an agreement is most likely registered abroad and has the right to purchase foreign securities. In most cases, a “scheme with a non-resident” is used, when a legal entity that is a non-resident of Ukraine actually participates in the auction. He is also the formal owner of all assets that are acquired on the stock exchange.

However, such a simple, at first glance, scheme has a number of significant drawbacks. Firstly, in fact, you do not become the owner of securities, which means that your property rights are not protected in any way. “Such proposals carry a great risk for the investor. After all, turning to such companies, you do not have legal protection. The contract is usually made with an obscure company that is registered, for example, in New Zealand, and in fact you do not own the securities. All this can lead to the fact that after a while the doors of the company will be closed, and the investor will be left without his investments, ”says Alexander Kulikov, head of the brokerage department at IG Univer.

All this can lead to the fact that after a while the doors of the company will be closed, and the investor will be left without his investments, ”says Alexander Kulikov, head of the brokerage department at IG Univer.

“Legally, a person who gave his money to such a company simply donated it to this company and can only count on its “good will” to return it,” sums up Ruslan Magomedov, director of Astrum Capital.

But even if the "broker" is not going to immediately embezzle your money, there is no guarantee that your profit or loss will depend on your ability to trade. “The so-called “kitchens” are hidden behind such proposals. In essence, these are bookmakers that accept bets on the rise or fall of a particular issuer's paper, but technically it looks like you are actually trading. The only truth is that the imaginary broker itself broadcasts quotes to you, which can be market quotes, or they can be taken “from the head” of this broker,” comments Ruslan Balaban.

If you still decide to trade through a similar scheme, then at least look on the Internet for reviews about the company and about withdrawing money from it. And most importantly - do not invest more than the amount with which you are ready to part.

Advantages of the method:

- minimum time and effort;

- the investor does not violate Ukrainian law.

Drawbacks:

- investor rights are not protected in any way, there is a huge risk of losing all invested capital.

Drawbacks of foreign shares

In addition to the disadvantages of each of the methods described above, trading in foreign securities in itself may not justify the investor's hopes, at least for enchanting profits. For example, after Polish investors got the opportunity to withdraw their capital to foreign stock markets, at first many people took advantage of this opportunity and began to invest in foreign securities. But later it turned out that in none of the developed stock markets in Europe there is no opportunity to receive such high profits as in Poland - the volatility of stable markets is low, the value of shares changes slowly. As a result, after a few months, the majority of Polish private investors returned back to their "own" market.

But later it turned out that in none of the developed stock markets in Europe there is no opportunity to receive such high profits as in Poland - the volatility of stable markets is low, the value of shares changes slowly. As a result, after a few months, the majority of Polish private investors returned back to their "own" market.

No matter how attractive Google or Apple stocks are, you will not be able to make a big profit with a small amount of starting capital by trading them. And Ukrainian private investors, most often, cannot afford large capital investments.

Of course, the volatility and unpredictability of the Ukrainian stock market requires good trading skills and professional training from an investor, but no one has canceled these requirements for traders on American or European stock exchanges.

Opinion

Ruslan Balaban, Senior Risk Manager Dragon Capital

If an investor is trying to buy shares through the so-called "kitchens", then he must understand that the loss of invested capital is only a matter of time.