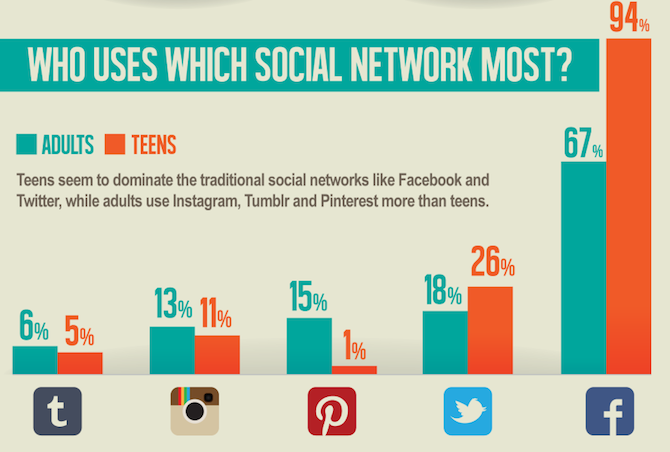

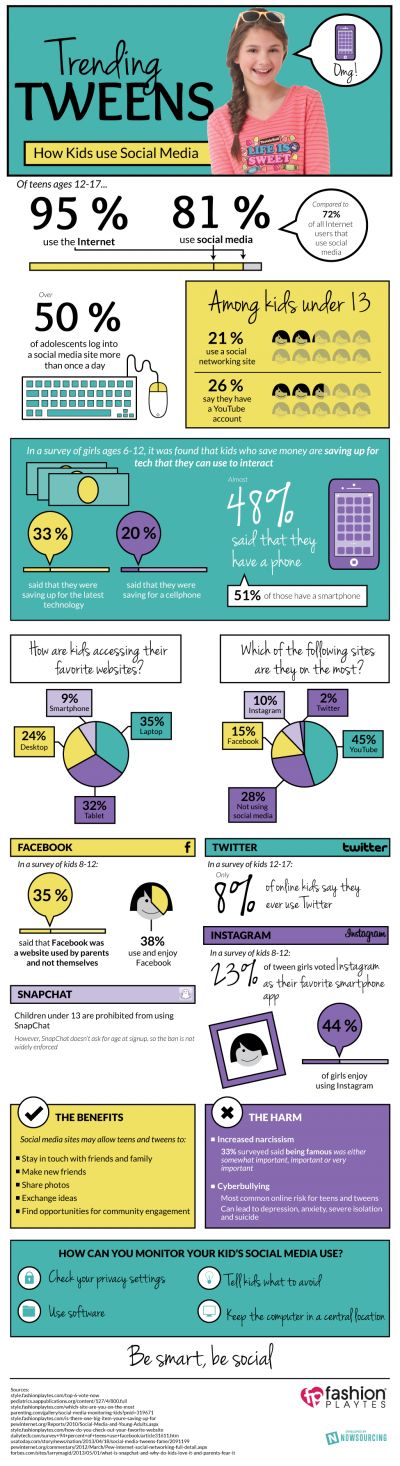

How many teens use instagram

Teens, Social Media and Technology 2022

TikTok has established itself as one of the top online platforms for U.S. teens, while the share of teens who use Facebook has fallen sharply

(Maskot/Getty Images)How we did this

Pew Research Center conducted this study to better understand teens’ use of digital devices, social media and other online platforms. For this analysis, we surveyed 1,316 U.S. teens. The survey was conducted online by Ipsos from April 14 to May 4, 2022.

This research was reviewed and approved by an external institutional review board (IRB), Advarra, which is an independent committee of experts that specializes in helping to protect the rights of research participants.

Ipsos recruited the teens via their parents who were a part of its KnowledgePanel, a probability-based web panel recruited primarily through national, random sampling of residential addresses. The survey is weighted to be representative of U.S. teens ages 13 to 17 who live with parents by age, gender, race, ethnicity, household income and other categories.

The trend data in this report comes from a Center survey on the same topic conducted from Sept. 25, 2014, to Oct. 9, 2014, and from Feb. 10, 2015, to March 16, 2015. The survey was fielded by the GfK Group on its KnowledgePanel, which was later acquired by Ipsos.

Here are the questions used for this report, along with responses, and its methodology.

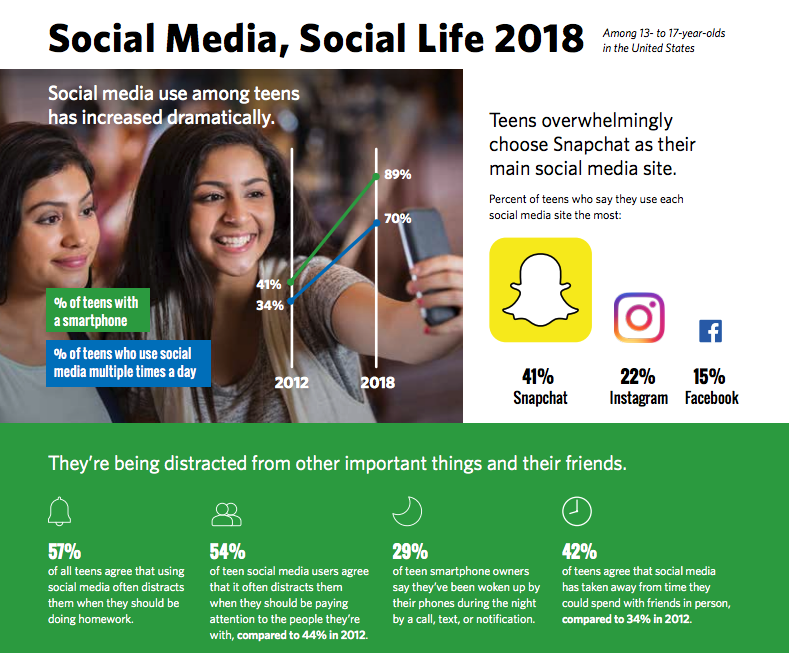

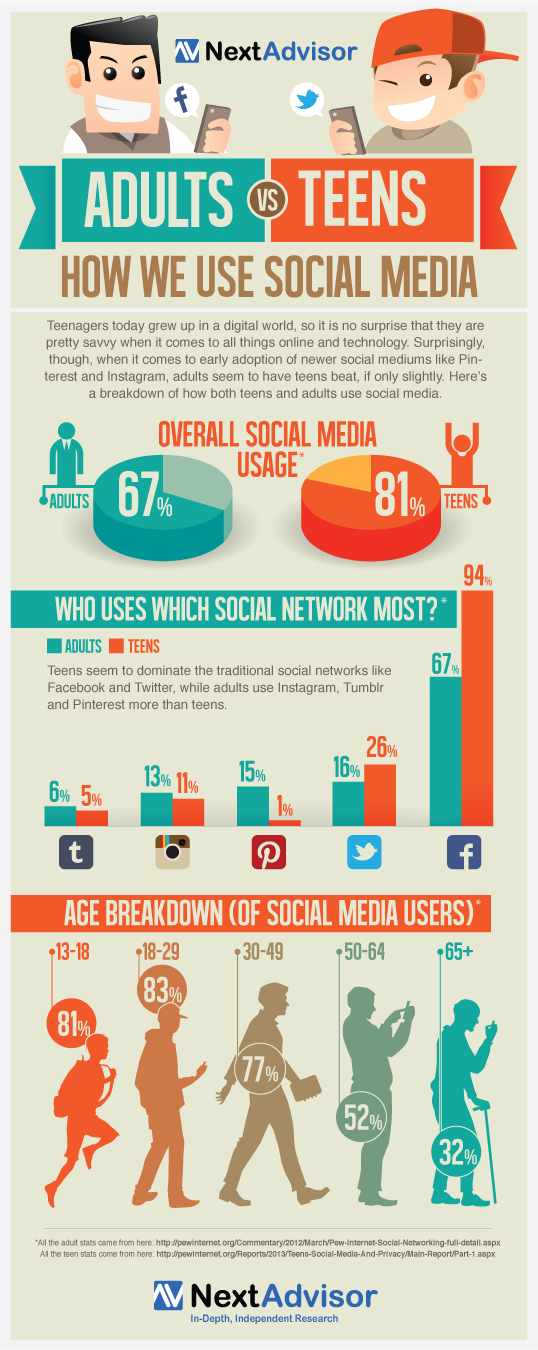

The landscape of social media is ever-changing, especially among teens who often are on the leading edge of this space. A new Pew Research Center survey of American teenagers ages 13 to 17 finds TikTok has rocketed in popularity since its North American debut several years ago and now is a top social media platform for teens among the platforms covered in this survey. Some 67% of teens say they ever use TikTok, with 16% of all teens saying they use it almost constantly. Meanwhile, the share of teens who say they use Facebook, a dominant social media platform among teens in the Center’s 2014-15 survey, has plummeted from 71% then to 32% today.

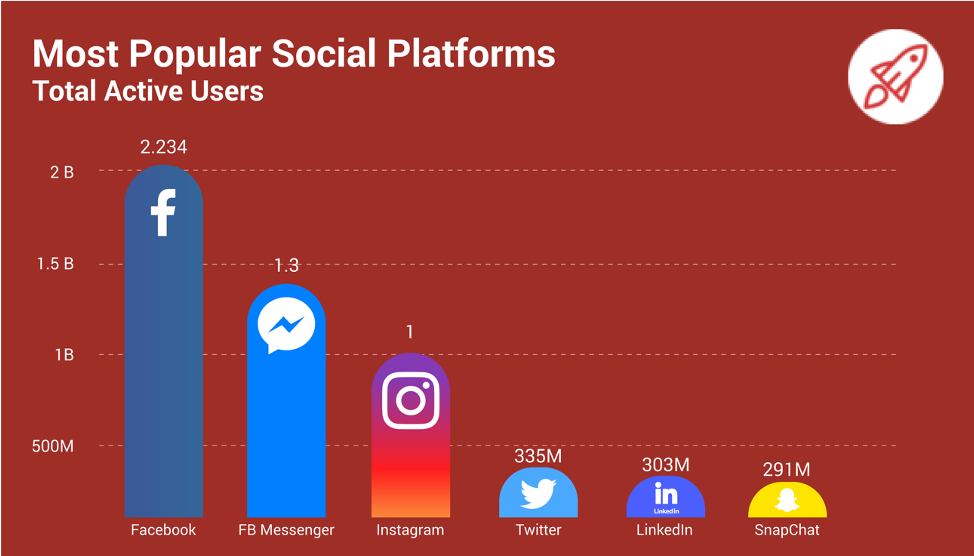

YouTube tops the 2022 teen online landscape among the platforms covered in the Center’s new survey, as it is used by 95% of teens. TikTok is next on the list of platforms that were asked about in this survey (67%), followed by Instagram and Snapchat, which are both used by about six-in-ten teens. After those platforms come Facebook with 32% and smaller shares who use Twitter, Twitch, WhatsApp, Reddit and Tumblr.1

Changes in the social media landscape since 2014-15 extend beyond TikTok’s rise and Facebook’s fall. Growing shares of teens say they are using Instagram and Snapchat since then. Conversely, Twitter and Tumblr saw declining shares of teens who report using their platforms. And two of the platforms the Center tracked in the earlier survey – Vine and Google+ – no longer exist.

There are some notable demographic differences in teens’ social media choices. For example, teen boys are more likely than teen girls to say they use YouTube, Twitch and Reddit, whereas teen girls are more likely than teen boys to use TikTok, Instagram and Snapchat. In addition, higher shares of Black and Hispanic teens report using TikTok, Instagram, Twitter and WhatsApp compared with White teens.2

In addition, higher shares of Black and Hispanic teens report using TikTok, Instagram, Twitter and WhatsApp compared with White teens.2

This study also explores the frequency with which teens are on each of the top five online platforms: YouTube, TikTok, Instagram, Snapchat and Facebook. Fully 35% of teens say they are using at least one of them “almost constantly.” Teen TikTok and Snapchat users are particularly engaged with these platforms, followed by teen YouTube users in close pursuit. A quarter of teens who use Snapchat or TikTok say they use these apps almost constantly, and a fifth of teen YouTube users say the same. When looking at teens overall, 19% say they use YouTube almost constantly, 16% say this about TikTok, and 15% about Snapchat.

When reflecting on the amount of time they spend on social media generally, a majority of U.S. teens (55%) say they spend about the right amount of time on these apps and sites, while about a third of teens (36%) say they spend too much time on social media. Just 8% of teens think they spend too little time on these platforms.

Just 8% of teens think they spend too little time on these platforms.

Asked about the idea of giving up social media, 54% of teens say it would be at least somewhat hard to give it up, while 46% say it would be at least somewhat easy. Teen girls are more likely than teen boys to express it would be difficult to give up social media (58% vs. 49%). Conversely, a quarter of teen boys say giving up social media would be very easy, while 15% of teen girls say the same. Older teens also say they would have difficulty giving up social media. About six-in-ten teens ages 15 to 17 (58%) say giving up social media would be at least somewhat difficult to do. A smaller share of 13- to 14-year-olds (48%) think this would be difficult.

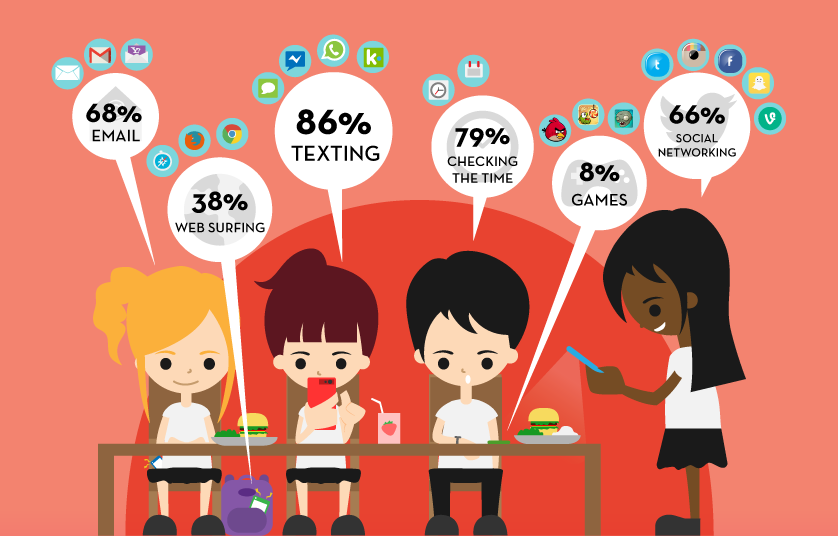

Beyond just online platforms, the new survey finds that the vast majority of teens have access to digital devices, such as smartphones (95%), desktop or laptop computers (90%) and gaming consoles (80%). And the study shows there has been an uptick in daily teen internet users, from 92% in 2014-15 to 97% today. In addition, the share of teens who say they are online almost constantly has roughly doubled since 2014-15 (46% now and 24% then).

In addition, the share of teens who say they are online almost constantly has roughly doubled since 2014-15 (46% now and 24% then).

These are some of the findings from an online survey of 1,316 teens conducted by the Pew Research Center from April 14 to May 4, 2022. More details about the findings on adoption and use of digital technologies by teens are covered below.

Smartphones, desktop and laptop computers, and gaming consoles remain widely accessible to teens

Since 2014-15, there has been a 22 percentage point rise in the share of teens who report having access to a smartphone (95% now and 73% then). While teens’ access to smartphones has increased over roughly the past eight years, their access to other digital technologies, such as desktop or laptop computers or gaming consoles, has remained statistically unchanged.

The survey shows there are differences in access to these digital devices for certain groups. For instance, teens ages 15 to 17 (98%) are more likely to have access to a smartphone than their 13- to 14-year-old counterparts (91%). In addition, teen boys are 21 points more likely to say they have access to gaming consoles than teen girls – a pattern that has been reported in prior Center research.3

In addition, teen boys are 21 points more likely to say they have access to gaming consoles than teen girls – a pattern that has been reported in prior Center research.3

Access to computers and gaming consoles also differs by teens’ household income. U.S. teens living in households that make $75,000 or more annually are 12 points more likely to have access to gaming consoles and 15 points more likely to have access to a desktop or laptop computer than teens from households with incomes under $30,000. These gaps in teen computer and gaming console access are consistent with digital divides by household income the Center has observed in previous teen surveys.

While 72% of U.S. teens say they have access to a smartphone, a computer and a gaming console at home, more affluent teens are particularly likely to have access to all three devices. Fully 76% of teens that live in households that make at least $75,000 a year say they have or have access to a smartphone, a gaming console and a desktop or laptop computer, compared with smaller shares of teens from households that make less than $30,000 or teens from households making $30,000 to $74,999 a year who say they have access to all three (60% and 69% of teens, respectively).

Almost all U.S. teens report using the internet daily

The share of teens who say they use the internet about once a day or more has grown slightly since 2014-15. Today, 97% of teens say they use the internet daily, compared with 92% of teens in 2014-15 who said the same.

In addition, the share of teens who say they use the internet almost constantly has gone up: 46% of teens say they use the internet almost constantly, up from only about a quarter (24%) of teenagers who said the same in 2014-15.

Black and Hispanic teens stand out for being on the internet more frequently than White teens. Some 56% of Black teens and 55% of Hispanic teens say they are online almost constantly, compared with 37% of White teens. The difference between Hispanic and White teens on this measure is consistent with previous findings when it comes to frequent internet use.

In addition, older teens are more likely to be online almost constantly. Some 52% of 15- to 17-year-olds say they use the internet almost constantly, while 36% of 13- to 14-year-olds say the same. Another demographic pattern in “almost constant” internet use: 53% of urban teens report being online almost constantly, while somewhat smaller shares of suburban and rural teens say the same (44% and 43%, respectively).

Another demographic pattern in “almost constant” internet use: 53% of urban teens report being online almost constantly, while somewhat smaller shares of suburban and rural teens say the same (44% and 43%, respectively).

Slight differences are seen among those who say they engage in “almost constant” internet use based on household income. A slightly larger share of teens from households making $30,000 to $74,999 annually report using the internet almost constantly, compared with teens from homes making at least $75,000 (51% and 43%, respectively). Teens who live in households making under $30,000 do not significantly differ from either group.

This survey asked whether U.S. teens use 10 specific online platforms: YouTube, TikTok, Instagram, Snapchat, Facebook, Twitter, Twitch, WhatsApp, Reddit and Tumblr.

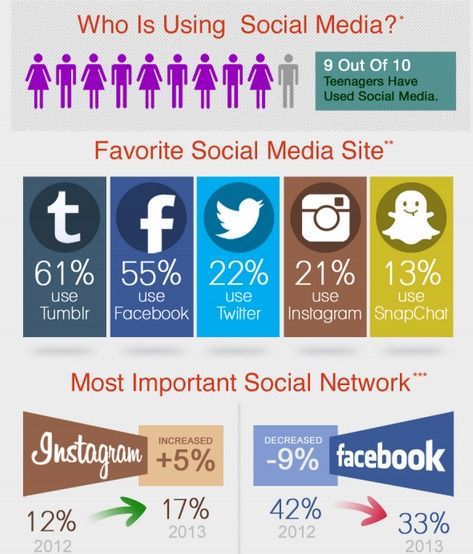

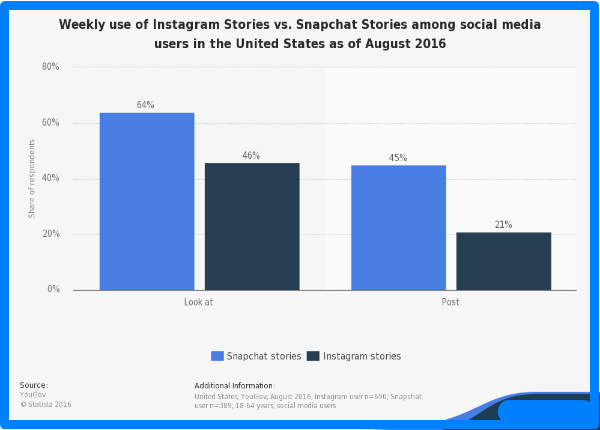

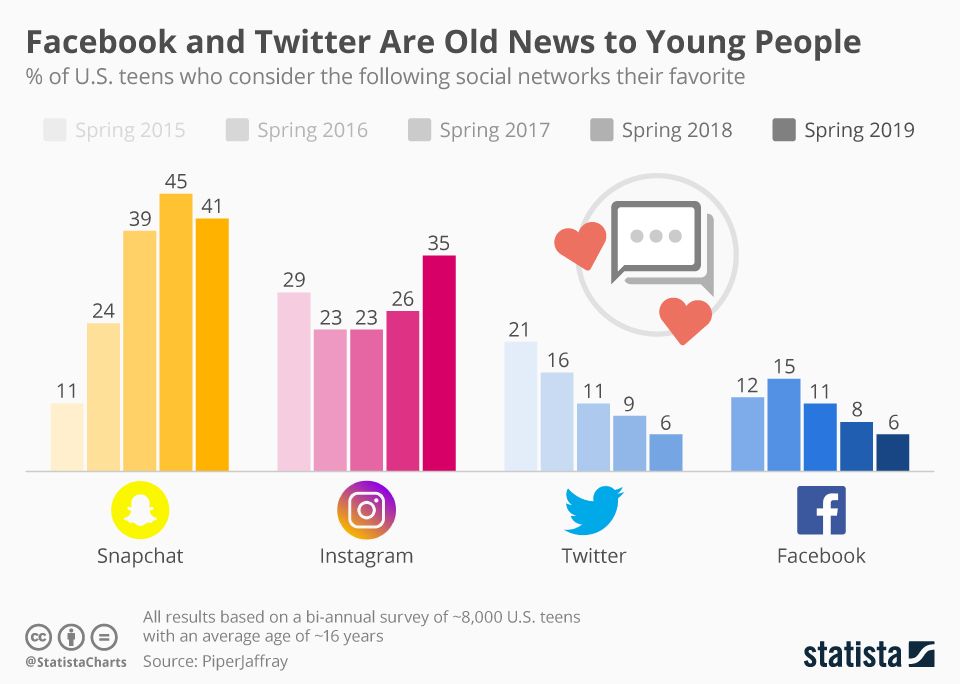

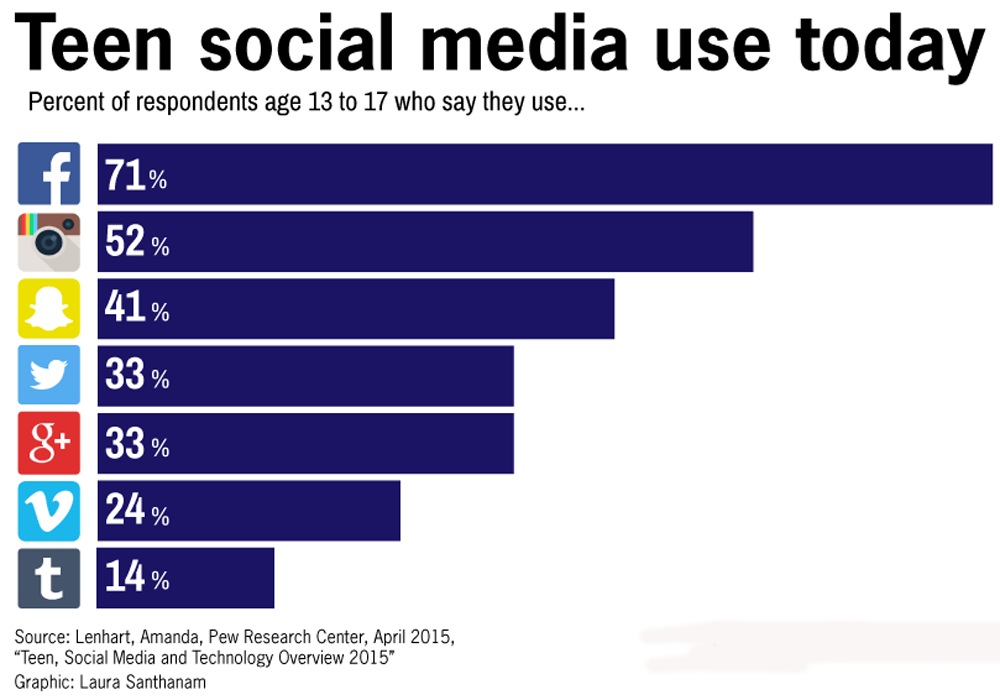

YouTube stands out as the most common online platform teens use out of the platforms measured, with 95% saying they ever use this site or app. Majorities also say they use TikTok (67%), Instagram (62%) and Snapchat (59%). Instagram and Snapchat use has grown since asked about in 2014-15, when roughly half of teens said they used Instagram (52%) and about four-in-ten said they used Snapchat (41%).

Instagram and Snapchat use has grown since asked about in 2014-15, when roughly half of teens said they used Instagram (52%) and about four-in-ten said they used Snapchat (41%).

The share of teens using Facebook has declined sharply in the past decade. Today, 32% of teens report ever using Facebook, down 39 points since 2014-15, when 71% said they ever used the platform. Although today’s teens do not use Facebook as extensively as teens in previous years, the platform still enjoys widespread usage among adults, as seen in other recent Center studies.

Other social media platforms have also seen decreases in usage among teens since 2014-15. Some 23% of teens now say they ever use Twitter, compared with 33% in 2014-15. Tumblr has seen a similar decline. While 14% of teens in 2014-15 reported using Tumblr, just 5% of teens today say they use this platform.

The online platforms teens flock to differ slightly based on gender. Teen girls are more likely than teen boys to say they ever use TikTok, Instagram and Snapchat, while boys are more likely to use Twitch and Reddit. Boys also report using YouTube at higher rates than girls, although the vast majority of teens use this platform regardless of gender.

Boys also report using YouTube at higher rates than girls, although the vast majority of teens use this platform regardless of gender.

Teens’ use of certain online platforms also differs by race and ethnicity. Black and Hispanic teens are more likely than White teens to say they ever use TikTok, Instagram, Twitter or WhatsApp. Black teens also stand out for being more likely to use TikTok compared with Hispanic teens, while Hispanic teens are more likely than their peers to use WhatsApp.

Older teens are more likely than younger teens to say they use each of the online platforms asked about except for YouTube and WhatsApp. Instagram is an especially notable example, with a majority of teens ages 15 to 17 (73%) saying they ever use Instagram, compared with 45% of teens ages 13 to 14 who say the same (a 28-point gap).

Despite Facebook losing its dominance in the social media world with this new cohort of teens, higher shares of those living in lower- and middle-income households gravitate toward Facebook than their peers who live in more affluent households: 44% of teens living in households earning less than $30,000 a year and 39% of teens from households earning $30,000 to less than $75,000 a year say they ever use Facebook, while 27% of those from households earning $75,000 or more a year say the same. Differences in Facebook use by household income were found in previous Center surveys as well (however the differences by household income were more pronounced in the past).

Differences in Facebook use by household income were found in previous Center surveys as well (however the differences by household income were more pronounced in the past).

When it comes to the frequency that teens use the top five platforms the survey looked at, YouTube and TikTok stand out as the platforms teens use most frequently. About three-quarters of teens visit YouTube at least daily, including 19% who report using the site or app almost constantly. A majority of teens (58%) visit TikTok daily, while about half say the same for Snapchat (51%) and Instagram (50%).

Looking within teens who use a given platform, TikTok and Snapchat stand out for having larger shares of teenage users who visit these platforms regularly. Fully 86% of teen TikTok or Snapchat users say they are on that platform daily and a quarter of teen users for both of these platforms say they are on the site or app almost constantly. Somewhat smaller shares of teen YouTube users (20%) and teen Instagram users (16%) say they are on those respective platforms almost constantly (about eight-in-ten teen users are on these platforms daily).

Not only is there a smaller share of teenage Facebook users than there was in 2014-15, teens who do use Facebook are also relatively less frequent users of the platform compared with the other platforms covered in this survey. Just 7% of teen Facebook users say they are on the site or app almost constantly (representing 2% of all teens). Still, about six-in-ten teen Facebook users (57%) visit the platform daily.

Across these five platforms, 35% of all U.S. teens say they are on at least one of them almost constantly. While this is not a comprehensive rundown of all teens who use any kind of online platform almost constantly, this 35% of teens represent a group of relatively heavy platform users and they clearly have different views about their use of social media compared with those who say they use at least one of these platforms, though less often than “almost constantly.” Those findings are covered in a later section.

Larger shares of Black and Hispanic teens say they are on TikTok, YouTube and Instagram almost constantly than White teens. For example, Black and Hispanic teens are roughly five times more likely than White teens to say they are on Instagram almost constantly.

For example, Black and Hispanic teens are roughly five times more likely than White teens to say they are on Instagram almost constantly.

Hispanic teens are more likely to be frequent users of Snapchat than White or Black teens: 23% of Hispanic teens say they use this social media platform almost constantly, while 12% of White teens and 11% of Black teens say the same. There are no racial and ethnic differences in teens’ frequency of Facebook usage.

Overall, Hispanic (47%) and Black teens (45%) are more likely than White teens (26%) to say they use at least one of these five online platforms almost constantly.

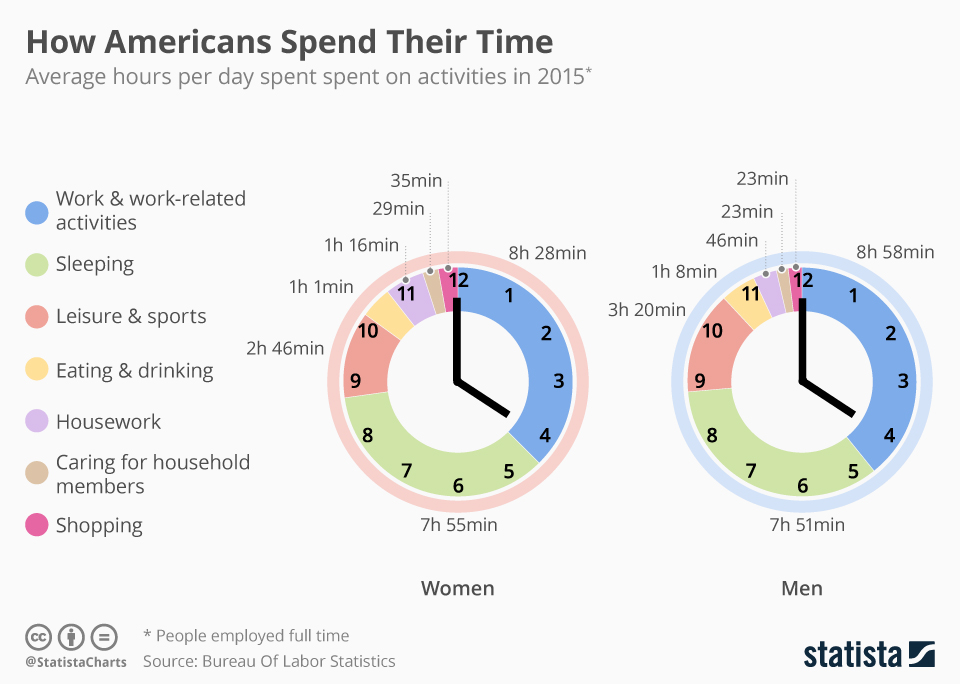

As social media use has become a common part of many teens’ daily routine, the Center asked U.S. teens how they feel about the amount of time they are spending on social media. A slight majority (55%) say the amount of time they spend of social media is about right, and smaller shares say they spend too much time or too little time on these platforms.

While a majority of teen boys and half of teen girls say they spend about the right amount of time on social media, this sentiment is more common among boys. Teen girls are more likely than their male counterparts to say they spend too much time on social media. In addition, White teens are more likely to see their time using social media as about right compared with Hispanic teens. Black teens do not differ from either group.

Teen girls are more likely than their male counterparts to say they spend too much time on social media. In addition, White teens are more likely to see their time using social media as about right compared with Hispanic teens. Black teens do not differ from either group.

This analysis also explored how teens who frequently use these platforms may feel about their time on them and how those feelings may differ from teens who use these sites and apps less frequently. To do this, two groups were constructed. The first group is the 35% of teens who say they use at least one of the five platforms this survey covered – YouTube, TikTok, Instagram, Snapchat or Facebook – almost constantly. The other group consists of teens who say they use these platforms but not as frequently – that is, they use at least one of these five platforms but use them less often than “almost constantly.”

When asked how they feel about the time they spend on social media, 53% of teens who almost constantly use at least one of the platforms say they are on social media too much, while about three-in-ten teens (28%) who use at least one of these platforms but less often say the same.

Teens who are almost constantly online – not just on social media – also stand out for saying they spend too much time on social media: 51% say they are on social media too much. By comparison, 26% of teens who are online several times a day say they are on social media too much.

When reflecting on what it would be like to try to quit social media, teens are somewhat divided whether this would be easy or difficult. Some 54% of U.S. teens say it would be very (18%) or somewhat hard (35%) for them to give up social media. Conversely, 46% of teens say it would be at least somewhat easy for them to give up social media, with a fifth saying it would be very easy.

Teenage girls are slightly more likely to say it would be hard to give up social media than teen boys (58% vs. 49%). A similar gap is seen between older and younger teens, with teens 15 to 17 years old being more likely than 13- and 14-year-olds to say it would be at least somewhat hard to give up social media.

A majority of teens who use at least one of the platforms asked about in the survey “almost constantly” say it would be hard to give up social media, with 32% saying it would be very hard. Smaller shares of teens who use at least one of these online platforms but use them less often say the same.

Smaller shares of teens who use at least one of these online platforms but use them less often say the same.

The teens who think they spend too much time on social media also report they would struggle to step back completely from it. Teens who say they spend too much time on social media are 36 percentage points more likely than teens who see their usage as about right to say giving up social media would be hard (78% vs. 42%). In fact, about three-in-ten teens who say they use social media too much (29%) say it would be very hard for them to give up social media. Conversely, a majority of teens who see their social media usage as about right (58%) say that it would be at least somewhat easy for them to give it up.

7 facts about Americans and Instagram

(Lorenzo Di Cola/NurPhoto via Getty Images)The photo and video sharing platform Instagram has become especially popular among young adults and teens. The site – a home for online influencers, political and election news and disinformation campaigns – has come under scrutiny after recently leaked research concluded that parent company Facebook knew the use of the site can have negative mental health effects for teenagers, especially teen girls.

Over the years, Pew Research Center has studied how U.S. adults – as well as teens and children – use and engage with the platform. Here are seven key takeaways from our research.

How we did this

Social media sites have become ubiquitous in American life. This analysis uses data from several Pew Research Center surveys to provide insights into who uses Instagram and their experiences with the platform.

All of the polls referenced here – including each survey’s mode, field dates and sample size – are available through the links in this analysis.

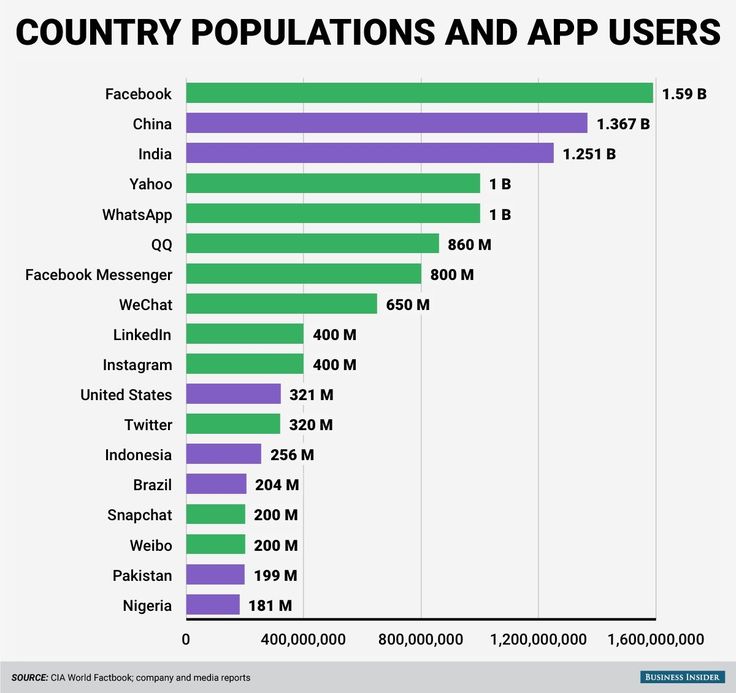

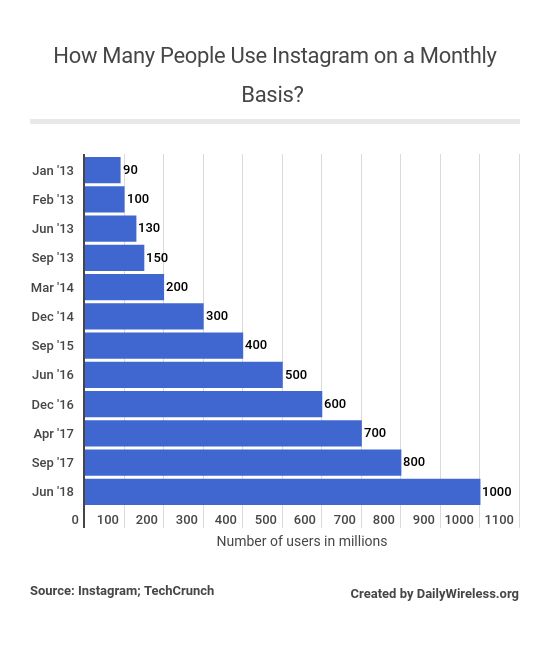

Four-in-ten Americans say they ever use Instagram, according to a survey conducted in January and February of 2021. The share of U.S. adults who say they have ever used the site has grown from 9% in 2012, when the Center first began asking about the platform. Despite this growth, much smaller shares of Americans use Instagram when compared with YouTube and Facebook, which are used by majorities of Americans (81% and 69%, respectively).

Young adults are the most likely group to say they use Instagram. Around seven-in-ten Americans ages 18 to 29 (71%) say they ever use Instagram. This compares with smaller shares of older age groups, with 48% of those ages 30 to 49, 29% of those 50 to 64 and just 13% of those 65 and older saying they use the platform, according to Center data from earlier this year.

A majority of adult Instagram users in the U.S. say they use the site at least once a day, and 38% say they use the site several times per day. About six-in-ten U.S. adults who use Instagram (59%) say they do so at least once a day. Among younger users, the share is larger: 73% of 18- to 29-year-old Instagram users say they visit the site every day, with roughly half (53%) reporting they do so several times per day. In contrast, 70% of adult Facebook users say they use the platform at least once a day, according to the 2021 survey findings.

In a spring 2018 survey, roughly seven-in-ten U. S. teens ages 13 to 17 (72%) said they used the site. Large shares of teens also said they used YouTube and Snapchat, according to a Center survey conducted in March and April of 2018. Some 15% of teens said Instagram was the platform they used “most often.” Larger shares said the same about Snapchat (35%) and YouTube (32%).

S. teens ages 13 to 17 (72%) said they used the site. Large shares of teens also said they used YouTube and Snapchat, according to a Center survey conducted in March and April of 2018. Some 15% of teens said Instagram was the platform they used “most often.” Larger shares said the same about Snapchat (35%) and YouTube (32%).

Children ages 11 and younger also engage with Instagram, though in relatively small shares, according to a spring 2020 survey. Despite Instagram’s age guidelines, which usually restrict children younger than 13 from joining, some 5% of parents of a child age 11 or younger said that, as far as they know, their child uses Instagram. When considering only parents with a child ages 9 to 11, however, this share was 11%. Larger shares of parents with a child 11 and younger said their children used TikTok and Snapchat than said so about Instagram.

About three-in-ten Americans knew in 2019 that Instagram and WhatsApp are owned by Facebook. In a 2019 survey, Americans were asked questions about a range of digital topics, including some about the business of social media. Some 29% of Americans correctly identified WhatsApp and Instagram as companies owned by Facebook, while 22% answered the question incorrectly. The largest share (49%) said they weren’t sure about the answer to this question.

In a 2019 survey, Americans were asked questions about a range of digital topics, including some about the business of social media. Some 29% of Americans correctly identified WhatsApp and Instagram as companies owned by Facebook, while 22% answered the question incorrectly. The largest share (49%) said they weren’t sure about the answer to this question.

Instagram is not the topmost social media site for getting news. Around one-in-ten U.S. adults (11%) say they regularly get news on the platform, according to a 2021 survey. That’s far smaller than the shares who regularly get news on Facebook (31%) or YouTube (22%).

There are considerable demographic differences in who gets news from Instagram. Around six-in-ten of the site’s regular news users (63%) are women, while 36% are men, according to the same 2021 survey. Adults under the age of 30 make up 44% of the site’s news users, while smaller shares are older.

In a fall 2019 survey, few Americans trusted Instagram as a place to get political and election news. Just 6% of U.S. adults said they trusted Instagram as a place to get political and election news, with a much larger share (42%) saying they distrusted it for such information. Some 37% of U.S. adults said they neither trusted nor distrusted the site for this type of news.

Just 6% of U.S. adults said they trusted Instagram as a place to get political and election news, with a much larger share (42%) saying they distrusted it for such information. Some 37% of U.S. adults said they neither trusted nor distrusted the site for this type of news.

Note: This is an update of a post originally published Oct. 21, 2019, and written by Brooke Auxier, former research associate.

Instagram audience research: every tenth person in Russia uses the service, the majority are women

- Technology

- Angelina Krechetova Editorial Forbes

Children — Android, Moscow — Apple, and other conclusions of the study of the photoreview audience in Russia, which will be useful to advertisers and marketers

According to a new study of Instagram users in Russia, about 10% of Russians use the photo and video sharing service, that is, 14. 4 million people out of a total population of 146.5 million. Research conducted on the basis of Facebook Ads data by Danil and Anton Salyukov, the founders of Insense, is at the disposal of Forbes.

4 million people out of a total population of 146.5 million. Research conducted on the basis of Facebook Ads data by Danil and Anton Salyukov, the founders of Insense, is at the disposal of Forbes.

Finished reading here

According to the authors, Instagram itself has not provided detailed statistics on its users in individual countries for a long time. Only in April, Instagram for the first time announced an official estimate of the number of its Russian users. Thus, in March, the audience of this service in Russia amounted to 22 million people a month, said Robert Bednarsky, regional director of Facebook in Central and Eastern Europe.

According to the results of the study, the maximum number of Instagram users in Russia is concentrated in Moscow - every fourth resident of the capital has an account in this social network. In St. Petersburg - every fifth. Collectively, about 22.5% of the population lives in Russian cities with a million population and almost 52% of the total number of all Instagram users in Russia is concentrated, the report says.

In St. Petersburg - every fifth. Collectively, about 22.5% of the population lives in Russian cities with a million population and almost 52% of the total number of all Instagram users in Russia is concentrated, the report says.

Almost 60% of Instagram users are women and 40% are men. The age characteristics are as follows: the “favorite by marketers” audience aged 18-34 is almost 67% of all Russian Instagram users. Adolescents aged 13-17 use the service less actively, their share is 12.3%, and female representatives are also in the majority here (almost 67%). However, as the age increases, men are more actively connected to the social network: for example, in the age group of 25-34 years, where the maximum share of male users is already more than 41%.

See also: Entertainment industry: how to make money on what others spend on? and Facebook for sneakers: when will social commerce come into life?

Android or iOs

Researchers note that teenagers (13-17 years old) prefer to buy equipment based on the Android OS - such users among young people are more than 60%. If you look at operating systems by all age groups, then Android users account for almost 52%. iOs users - about 36%. It is noteworthy that 12.32% own equipment both on iOs and Android. Thus, every 10th user has an additional device on a different operating system. At the same time, the only city where fans of Apple technology dominate among Instagram users (44.11%) is Moscow, the authors of the study note.

Methodology

Danil Salyukov explained to Forbes that analysts usually use services to scan other social networks (for example, VKontakte), one by one studying links to Instagram in profiles, then analyzing gender, age and city, thus Thus, "getting a huge database of Instagram accounts, supplemented by socio-demographic data." “But there is an error - not all users have combined their Instagram profile with another social network,” he emphasizes. That is why, as part of their research, Insense collected data only on the service itself and on Facebook (Facebook bought Instagram for $1 billion in 2012).

That is why, as part of their research, Insense collected data only on the service itself and on Facebook (Facebook bought Instagram for $1 billion in 2012).

“First, we identified million-plus cities (15 cities in Russia), then for each city we divided the audience into main age groups — 13-17 (Facebook does not allow advertising for people under 13), 18-24, 25-34 , 35-54 and over 55. After that, we analyzed the data by gender and by the operating system of their devices (Android/iOs). After that, all the values were summed up, ”Insense explains in the message. Then, in order for the calculation to be correct, the authors of the work excluded million-plus cities from the general base and repeated all the steps according to the previous algorithm. The obtained values were summed up.

“We were interested in the number of Instagram users living in the largest cities of Russia, the ratio of men and women, and what devices they use to access the social network,” the authors of the work explain. Anton Salyukov clarifies that her results are aimed "at advertisers, as well as business owners who do not understand what Instagram is for." The findings will be of more interest to marketers who need to understand the age of the audience, where it is concentrated and, if developing a mobile application, which operating system should be emphasized, he notes.

Anton Salyukov clarifies that her results are aimed "at advertisers, as well as business owners who do not understand what Instagram is for." The findings will be of more interest to marketers who need to understand the age of the audience, where it is concentrated and, if developing a mobile application, which operating system should be emphasized, he notes.

See also: In the footsteps of billionaires. What stocks to buy after the Forbes list is published

-

Angelina Krechetova

Editorial Forbes

#Instagram #the audience #study #service #users

Forbes Newsletter

The most important thing about finance, investment, business and technology

Instagram in Russia is growing in regions and audience 35+

Depositphotos

The main increase in the Russian audience of Instagram came from the regions, and the fastest growing segment was 35+. In 2017, the number of users older than 35 almost quadrupled. The share of young users (13-34) fell from 79.3% to 54.7%.

In 2017, the number of users older than 35 almost quadrupled. The share of young users (13-34) fell from 79.3% to 54.7%.

These are the results of a study of Insense, a service for brands working with Instagram bloggers (the day before, it raised $1 million from venture funds and private investors). Service analysts studied Instagram audience growth trends in Russia, their age and regional distribution, as well as data on social network mobile platforms.

The two main trends of 2017 were the active penetration of the social network into the regions and the “maturing” of the audience. The penetration of the social network in Russia has increased, primarily due to million-plus cities. Most noticeably - 2.5 times - the concentration of users increased in Kazan, where 62.3% of the population use the service. The second and third places are Samara and Yekaterinburg - 61.6% and 55.5%, respectively. These cities also lead in terms of audience growth: here the number of users has more than doubled.

The share of Moscow accounts in the service decreased by 13.8%, while a year earlier the capital was the leader in terms of user concentration — 27.6% of the population used Instagram there. But now almost half of Moscow residents (47.1%) have an account. St. Petersburg is also far from the leading position, although 40% of the city's population has an account. In total, 22.5% of the population is concentrated in the 15 largest million-plus cities in Russia, half of which (49.9%) are Instagram users.

Insense Study

Despite the fact that women are still in the majority (59.3%), the share of men on Instagram is growing significantly faster. In general, in Russia, the stratum of male users grew by 4.6% over the year compared to women. In certain cities, such as Chelyabinsk and Novosibirsk, it increased by 8.1%. Over the year, the sex ratio in these regions approached that characteristic of the country as a whole.

The main driver of audience growth was users over 35 years old, and men connect to the social network faster. Thus, men aged 45 to 54 registered six times more actively than other categories in the service. The number of women of the same age registered in the service is larger, but the growth rate is lower.

Thus, men aged 45 to 54 registered six times more actively than other categories in the service. The number of women of the same age registered in the service is larger, but the growth rate is lower.

In 2016, young people (18-34) were considered the main segment of the social network - this category accounted for 67% of the audience. Now she represents 47.7% of the audience of the service. The teenage audience is growing the slowest (13-17), over the year this segment has increased in number by 12.2%. At the same time, its share in the total mass decreased by 43.3%. Now teenagers make up only 7% of service users in the country.

Insense Research Insense Research

“The teenage audience has been growing slowly for the second year in a row. One of the possible explanations could be the active arrival of the generation of their parents on Instagram. Now Instagram retains existing users in this segment, however, messengers are more actively involved in new audiences, since it is in them that young people can communicate with each other without the attention of older ones. Over time, this can form a new type of user behavior. Now this opens up a new research challenge for us — to segment and study the Snapchat audience,” says Danil Salyukov, head of Insense.

Over time, this can form a new type of user behavior. Now this opens up a new research challenge for us — to segment and study the Snapchat audience,” says Danil Salyukov, head of Insense.

Android devices are used by 56.4% of registered Instagram users. The number of users of this OS has more than doubled over the year, and the number of owners of iOS equipment has increased by 70%. At the same time, the share of iOS users on Instagram decreased by 10.7%, and now this operating system is inferior to its main competitor even in Moscow, where there were more fans of Apple technology a year earlier.

The dependence of OS on age, noted in 2016, ceases to be traced. A year earlier, the largest share of Android users was observed in the group of teenagers — 60% of users went to Instagram from smartphones and tablets on this OS. The older age segments were characterized by a gradually increasing share of Apple technology. In 2017, the situation is reversed.

The prevalence of Android in all ages was driven by a sixfold increase in OS-based device users aged 45-54.